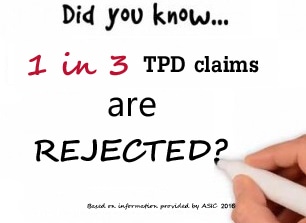

If you have a TPD claim which has been rejected or has not been decided by an insurer after a minimum of 3-6 months then you may be entitled to enforce your rights through the Courts.

How can the courts help

The primary benefit you receive from starting court proceedings is that you gain some control back over your claim. A super fund and their insurer are under no compulsion to do anything quickly when it comes to your TPD claim. Unlike other types of insurance claims, superannuation claims are largely unregulated until you get the Courts involved. There are specific Court rules which apply to all claims that “facilitate the just and expeditious resolution of the real issues … at a minimum of expense.”[1] This means a defendant must comply with set timeframes to respond to a Court claim. The Court also has wide powers to make orders penalising parties who do not comply with the Rules. A Court can also order an insurer and super fund to participate genuinely in negotiations to try and resolve a claim without going to Court.

Benefits of court proceedings

Another benefit of Court proceedings is that if your claim is successful the Court will usually order that the insurer pay interest on the benefits from the time that they should have reasonably been paid, usually a minimum of 3-6 months after the claim was lodged.

A deterrent for people getting the courts involved is the perceived cost of having lawyers act for you in Court. In TPD claims if you win the insurer will have to pay some of your costs. At a minimum they are usually required to pay at least half. In some cases if your lawyers run the claim efficiently and tactically smart the defendants may end up paying 90% or more of your costs. The costs burden is well worth it to get some control back and to maximise your chances of succeeding.

Case Example

For example where the TPD benefit is $100,000, if you issue court proceedings which go to judgement and you win, the Court will award the payment of damages to you of at least $100,000 plus interest of approximately $8,500 (assuming the case is finalised within 9 months). You would also recover some costs from the other side. If you make a formal offer under the Rules to settle your claim for $95,000 plus costs which is rejected you would beat that offer in Court and recover indemnity costs. This usually means between 90-100% of your actual costs.

It is worth noting that in Tribunal or Ombudsman complaints there is no power for you to be awarded interest or costs.

[1] Rule 5 Uniform Civil Procedure Rules 1999 (Qld); see also Regulation 2.1 of the Uniform Civil Procedure Rules 2005 (NSW) which require the “just, quick and cheap disposal of the proceedings.”

Contact Super Claims Australia

Should you have any queries whatsoever or wish to discuss your superannuation or life insurance claim please do not hesitate to contact us on 13 43 63.